PART I. MULTIPLE

CHOICE

1.

Which of the following is not considered one of the four broad categories of

competitive priorities?

A. Technology

B. Cost

C. Time

D. Quality

E. Flexibility

2.

The impact of an organization’s strategy on the

organization is

A. Long-term

B. Medium-term

C. Short-term

D. Day-to-day

E. Temporary

3.

Productivity can be improved by

A. Increasing

inputs while holding outputs steady

B. Decreasing

outputs while holding inputs steady

C. Increasing

inputs and outputs in the same proportion

D. Decreasing inputs while holding outputs steady

E. None

of the above

4.

If inputs increase by 30% and outputs decrease by 15%,

what is the percentage change in productivity?

A. 100%

decrease

B. 11.54%

increase

C. 34.62% decrease

D. 15%

increase

E. 15%

decrease

5. For which of the following is break-even analysis

not appropriate?

A. Deciding

how much of a product must be sold to make a profit

B. Evaluating

different processes

C. Deciding

whether it is better to make or buy a product

D. Deciding

between different products

E. Deciding how to allocate overhead

6.

Insourcing incurs an annual

fixed cost of $500,000 and a variable cost of $60 per unit. Outsourcing incurs an annual fixed cost of

$750,000 and a variable cost of $20 per unit.

What is the indifference point between the two alternatives?

A. 1250

B. 12500

C. 6250 500,000

+ 60Q = 750,000 + 20Q

D. 62500

E. 40

7.

Which of the following is characteristic of

continuous operations?

A. Produce many different products with varying

processing requirements

B. Capital

intensive

C. Workers need to be able to perform different

tasks depending on the processing needs of the product

D. General purpose equipment

E. Volume of goods produced directly tied to

number of customer orders

8.

A company that is highly vertically integrated will

A. Own its raw material

sources, factories, and product distribution system

B. Be a supplier for manufacturing companies

C. Rely on vendors for raw materials and parts

D. Have a flat organization chart

E. Be a monopoly

9.

What refers to owning or controlling the channels of

distribution?

A. Backward integration

B. Vertical integration

C. Horizontal integration

D. Forward

integration

E. Enterprise integration

10.

What is the probability of a Type I error for a

control chart with limits set at ±

3 standard deviations from the mean?

A. 4.56%

B. 0.26%

C. 99.74%

D. 95.44%

E. Cannot be determined

11.

For which of the following would a control chart for

attributes not be appropriate?

A. Number of nonfunctioning light bulbs

B. Proportion of broken eggs in a carton

C. Number of rotten apples

D. Number of complaints issued

E. Length of

metal rods

12.

Suppose that you want to measure the percentage of

candles that are cut longer than 9 inches.

Which control chart would be appropriate?

A. Mean chart

B. Range chart

C. Count chart

D. Proportion

chart

E. Flow chart

13.

Which of the following is not a dimension of quality that we learned in class?

A. Quality of conformance to design

B. Quality of

production process

C. Post-sale service

D. Quality of design

E. Ease of use

14.

An executive conference center has the physical

ability to handle 1,100 participants.

However, conference management personnel believe that only 1,000

participants can be handled effectively for most events. The last event, although forecasted to have

1,000 participants, resulted in the attendance of only 950 participants. What is the conference facility’s capacity

utilization relative to its design capacity?

A. 100%

B. 86.4% (Effective capacity

= 1000; design capacity = 1100; actual output = 950; Utilization(Design)=950/1100)

C. 95%

D. 110%

E. 90.9%

15.

The maximum output rate that can be achieved by a

facility under ideal conditions

A. Utilization

B. Effective capacity

C. Design

capacity

D. Ultimate capacity

E. Temporary capacity

16.

Which of the following is not a determinant of effective capacity?

A. Scheduled machine maintenance

B. Lunch breaks

C. Realistic work schedules

D. Regular staff levels

E. Overtime

(Effective capacity: output under normal condition)

PART

II. PROBLEM SOLVING

Question

1.

C&A

bakery produces 1500 loaves of

bread a month. Labor productivity is

2.344 loaves per labor-hour. Each worker

works 160 hours per month for $8 per hour.

Utility costs $500 per month. Ingredients cost $0.35 per loaf.

(a)

How many

workers do C&A currently use?

(b)

What is C&A’s multifactor productivity?

(c)

How many

workers will C&A need to add in order to meet an anticipated 25% increase

in bread demand?

(d)

What is C&A’s multifactor productivity with an increase in

labor suggested in (c)?

(e)

Compare

the change in productivity between (b) and (c).

(a) Outputs/Inputs = Productivity

Given: Outputs = 1500 and

Productivity = 2.344 loaves per labor-hour

Thus, Labor-hours = 1500/2.344 = 640

hours

Given: each worker works 160 hours

per month

Thus, number of workers used =

640/160 = 4

(b) Multifactor productivity = Outputs/(Labor cost + Utility cost + Ingredients cost)

Output = 1500 loaves

Labor cost = 640 hours x $8

Utility cost = $500

Ingredients cost = 1500 x $0.35

Thus, multifactor productivity =

1500/6145 = 0.244

(c) New output = 1500 x (1+25%) = 1875

Labor-hours

needed = 1875/2.344 = 800 hours

Number

of workers needed = 800/160 = 5

č Need to add 1 worker

(d) Multifactor

productivity = Outputs/(Labor cost + Utility cost +

Ingredients cost)

Output = 1875 loaves

Labor cost = 800 hours x $8

Utility cost = $500

Ingredients cost = 1875 x $0.35

Thus,

multifactor productivity = 1875/7556.25 = 0.248

(e) Change

in productivity = (0.248-0.244)/0.244 = 1.6%

(a) TC_manual = $15000

+ ($350+$350) x 200 = $155000

TC_semiautomatic

= $35000 + ($330+$270) x 200 = $155000

TC_automatic =

$80000 + ($350+$130) x 200 = $176000

Either the manual and semi-automatic production method gives the lowest

total costs. C&A can choose one of

these methods.

(b) From (a), when Q1=200 is the indifference

point between manual and semi-automatic

Let Q2 be the indifference point between

semiautomatic and automatic method

i.e., 35000 + 600 Q2 = 80000 + 480 Q2

Q2 = (80000-35000)/(600-480)

= 375

Thus, 1 <= Q <= 200 choose manual

200 <= Q <= 375 choose semiautomatic

Q >= 375 choose automatic

(c)

(d) R = 800 Q

(e) Let Q be the break-even point when revenue

equals to total costs

i.e., 800 Q = 15000 + 700 Q

Q = 15000/(800-700) =

150

(f) Profit = Revenue – Total costs

= 800 x 1000 – (15000 + 700 x 1000)

= 800000 – 715000 = 85000

Question

3.

100 IRS

representatives are monitored daily.

Incidents of incorrect information or impoliteness to customers are

recorded. The data for last week are:

|

Day

|

Number

of Non-conformities

|

|

1

|

52

|

|

2

|

27

|

|

3

|

35

|

|

4

|

44

|

|

5

|

55

|

(a)

What

kind of control chart should be used? Explain why.

(b)

Construct

a three-sigma control chart.

(c)

What

does the chart tell you?

(d)

If 65

nonconformities are recorded the next day, should any special action be taken?

(a)

The quality characteristic here is the “number of non-conformities”

which is counted on a discrete scale.

Thus, a control chart for attribute should be used. The number of non-conformities is counted

daily. Thus, a c-chart should be used.

(b)

CL = (52 + 27 + 35 + 44 + 55)/5 = 42.6

UCL

= 42.6 + 3  = 62.2

= 62.2

LCL

= 42.6 - 3  = 23.0

= 23.0

(c)

The chart is defined by a center line of 42.6, an upper control limit of

62.2 and a lower control limit of 23:

(d) 65 nonconformities go beyond

the UCL of 62.2, indicating that a quality problem exists

that needs special attention.

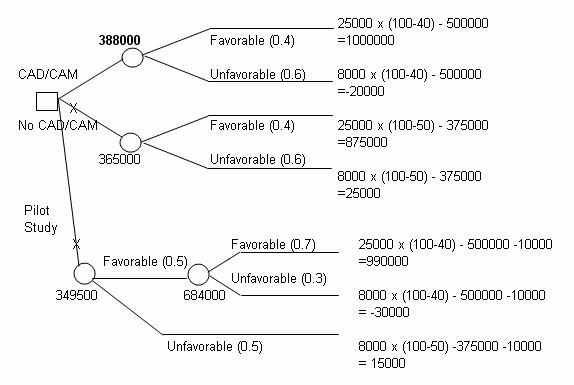

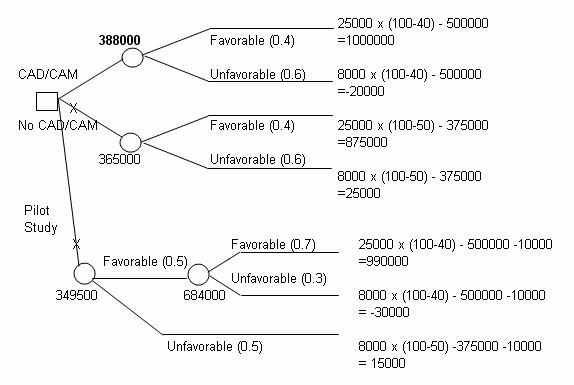

Question 4.

C&A, a cellular

phone manufacturer, is investigating the possibility of producing and marketing

a new line of phone. Undertaking this project

will require either purchasing a CAD/CAM system or hiring and training several

additional engineers, or purchasing a CAD/CAM system after a pilot study. The market for the product could be either

favorable or unfavorable. With favorable

acceptance by the market, sales would be 25,000 phones selling for $100 each,

and with unfavorable acceptance, sales would be only 8,000 phones selling for

$100 each.

The cost of the

CAD/CAM equipment is $500,000, but that of hiring and training three new engineers

is only $375,000. However, manufacturing

cost should drop from $50 each when manufacturing without CAD/CAM to $40 each

when manufacturing with CAD/CAM. The

probability of favorable acceptance of the new phone is 0.40; the probability

of unfavorable acceptance is 0.60.

The other option is

to conduct a pilot study and then decide whether or not to purchase a CAD/CAM

system. The pilot study will cost

$10,000. C&A will purchase the

CAD/CAM system only if the result of the pilot study is positive. The probability of a positive pilot study is

50%. At this time, the probability of

favorable acceptance of the new phone will be increased to 70%. All other costs and sales figures remain the

same.

(a)

Draw a

decision tree showing the decision, chance events, and their probabilities, as

well as the profitability of outcomes.

(b)

Solve

the decision tree and decide what C&A should do.

(a)

(b) C&A should

produce and market a new line of cellular phone by purchasing a CAD/CAM

directly. The expected profit is

$388,000.

![]() = 62.2

= 62.2![]() = 23.0

= 23.0