Budget at a Glance

Planning for the future

The university’s strategic plan, The UK-Purpose (Plan for Unprecedented Research, Purposeful and Optimal Service and Education) is framed by five principles:

Putting Students First: They are why we are here. Whether it is maintaining and enhancing a modern curriculum that prepares all our students for success, providing appropriate support for graduate students or ensuring that doctoral students start and complete their programs successfully, we must put students first.

Taking Care of Our People: We will only accomplish our mission of advancing Kentucky when our people — those who work with us and those we serve — are cared for holistically: their health, their safety, their well-being and their ability to prosper.

Inspiring Ingenuity: How do we embed innovation and discovery into every aspect of our institution? The breadth and depth of programming and offerings available on one campus makes us distinctive in higher education. How do we incentivize the spark of ingenuity throughout our campus?

Ensuring Greater Trust, Transparency and Accountability: We are Kentucky’s institution. And that mantle holds with it heightened responsibilities of accountability and transparency. But we need to do more to instill a sense of trust in each other in everything that we do.

Bringing Together Many People, One Community: UK is among the most diverse communities in the Commonwealth. Our students will enter a world riven by divisions, but more interdependent than ever before. How do we model unity amidst diversity for our state?

As used for many years and in alignment with the strategic plan, the following principles guided the development of the Fiscal Year (FY) 2023-24 budget:

Enduring Budget Development Principles

- Student access and affordability

- Competitive pay for faculty and staff

- Strategically plan to prevent across-the-board cuts and maintain and enhance academic quality

- Building a community of belonging

Budget grows by 20 percent

The president is responsible for the preparation of an annual budget for consideration and approval by the Board of Trustees (Board). A balanced budget is generally presented to the Board in June, preceding the start of the fiscal year (July 1 through June 30). Budget revisions may be considered by the Board throughout the fiscal year.

The university’s recommended FY 2023-24 consolidated original budget totals $6,780,322,900, an increase of $1,168,630,400 (20.8 percent) compared to the prior fiscal year original budget. Since FY 2013-14, the university’s original operating budget will have increased 150.3 percent, from $2.7 billion to $6.8 billion.

The accounting systems for large, public doctoral research universities are complex due to the breadth of operations beyond academic programs such as academic medical centers, land-grant missions for agricultural research and extension, sponsored projects, endowments, and intercollegiate athletics. The accounting systems are further complicated due to adherence with accounting principles and standards, spending restrictions, and financial reporting requirements. Because the university receives funding from a variety of sources, with different types of terms and restrictions, each source is tracked individually in unique funds.

The university’s consolidated budget establishes the expenditure authority for each area, college and department. The university’s executive leadership (president, provost, executive vice president for finance and administration [EVPFA], and executive vice president for health affairs [EVPHA]) is responsible for the programmatic and fiscal management of the various areas of the university, including preparing, deploying and managing the budget.

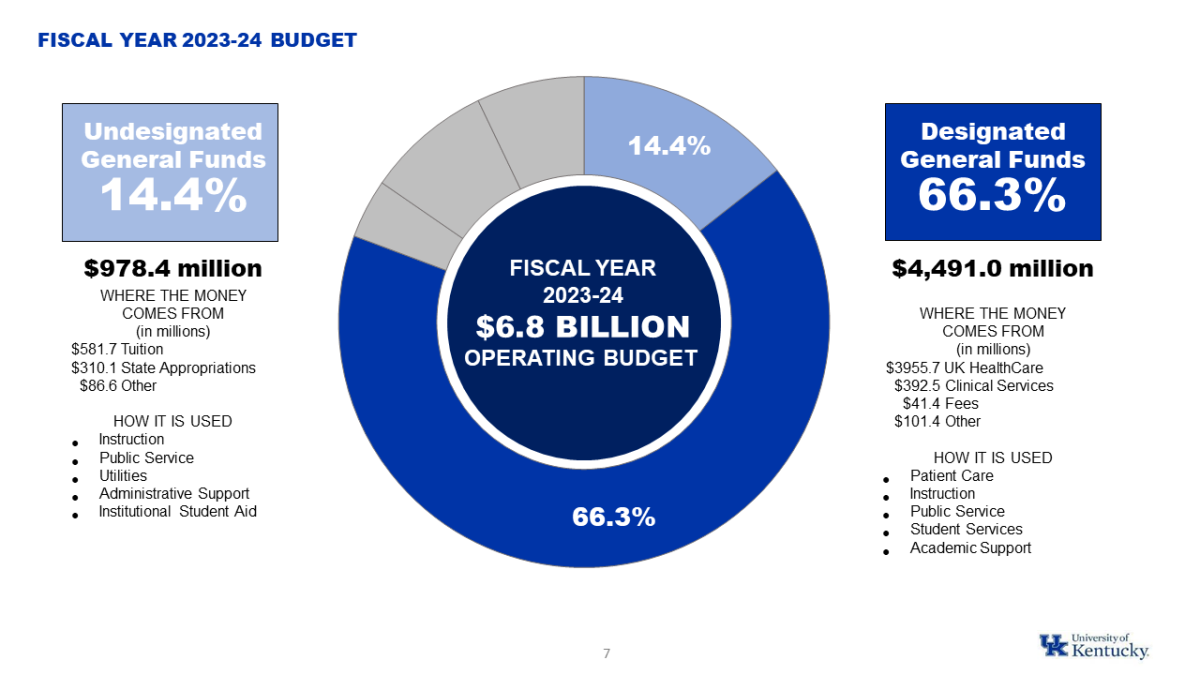

Operating Budget by Fund Group

General Funds

General Funds are unrestricted resources that comprise the majority of the university’s operating budget. The activities supported with General Funds constitute the core instructional, service, student support and administrative functions of the university. General Funds are further classified as Undesignated General Funds or Designated General Funds.

Undesignated General Funds

Undesignated General Funds (UDGF) include state appropriations, student tuition, and other income. These revenues are received and managed centrally with the associated expenditure authority allocated to colleges and departments. Functions supported with UDGF constitute the core educational and general activities of the university. For FY 2023-24, UDGF comprise 14.4 percent of the university’s total budget.

Designated General Funds

Designated General Funds (DGF) are received directly by the colleges, departments and enterprises that receive or earn the revenue. Units use the funds in accordance with the stated purpose of the funds and the units’ missions. For FY 2023-24, DGF comprise 66.3 percent of the university’s total budget. At a projected budget of $4.0 billion, the university’s largest revenue source is from hospital services. The FY 2023-24 budget reflects a $1.2 billion increase in UK HealthCare’s hospital services primarily due to the acquisition of King’s Daughters Health System (KDHS) effective December 1, 2022.

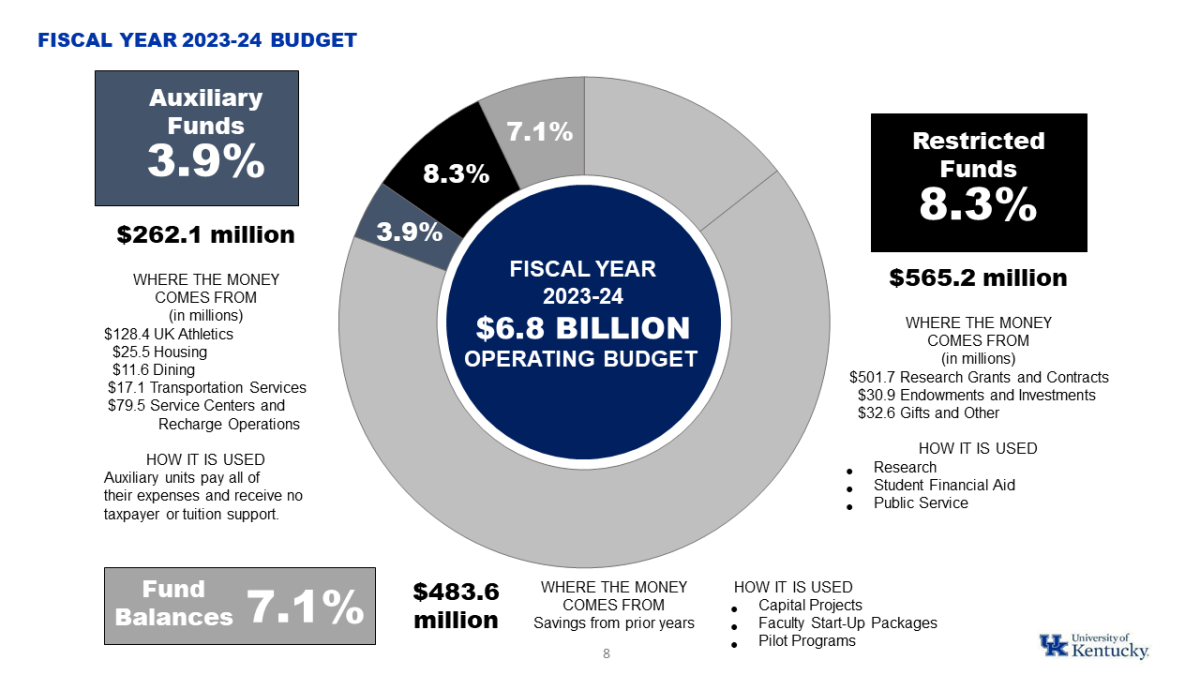

Auxiliary Funds

Auxiliary Funds are generated from the sale of goods and services to faculty, staff, students and the community. Revenues are expected to cover the operating expenses of each auxiliary enterprise. UK Athletics, UK Campus Housing, UK Dining, Transportation Services, service centers and recharge operations generate the majority of Auxiliary Funds. For FY 2023-24, Auxiliary Funds comprise 3.9 percent of the university’s budget.

Restricted Funds

Restricted Funds are accepted by the university with explicit constraints imposed by external entities or donors. The primary sources of Restricted Funds are sponsored projects such as grants and contracts, gifts that must be spent in support of specific programs, and federal and state student financial aid. The university has a legal obligation to abide by the restrictions. For FY 2023-24, Restricted Funds constitute 8.3 percent of the university’s total budget.

Fund Balances

The university’s operating budget includes expenditure authority for prior-year unspent funds (i.e., Fund Balances) accumulated within each of the primary fund groups (General Funds, Auxiliary Funds and Restricted Funds). Fund balances are considered non-recurring or one-time funds. For FY 2023-24, Fund Balances account for 7.1 percent of the university’s total budget.