Over 60 Day Taxation

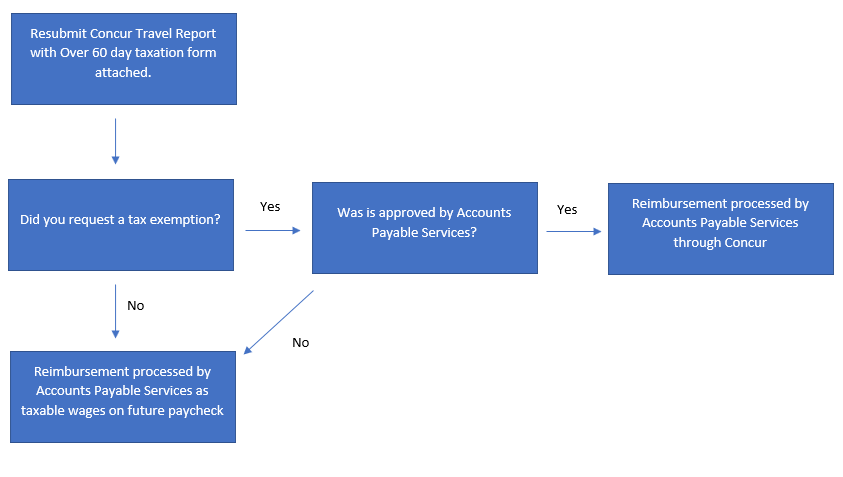

If Travel Services returned a Travel Expense Report for revision requiring an Over 60 Day Taxation Form, please follow the process below:

In compliance with IRS rules for an accountable plan and UK BPM E-5-1, employees must complete and approve the Concur Travel report for all business expenses within 60 calendar days of the date when business travel ends to be considered a reasonable period of time. For employees who have not met the 60-day approval deadline and have not received an approved taxation exemption, reimbursement will be processed as taxable wages on a future paycheck.